Is any anger campaign organic?

It might seem like a silly question, as we already known that “going viral” is largely a planned and calculated event, designed by firms to generate followers and purchases. That’s old news. The real query relates to whether these “outrage activist” movements are not aligned with the same interests.

Think about it for a second: at the beginning of December, Peloton’s cute holiday mom ad began to generate substantial controversy for its depiction of a woman working out.

Fat activists were furious at the misogyny and sexism, because the husband is not shown working out, and his wife already happens to be slim. Those who thought the fury was silly probably pointed out that exercising is not just about losing weight, but also remaining healthy.

Now, I will not pretend the Denny’s Division was not at some level legitimate; after all, we are well aware of the Trigglypuff saga.

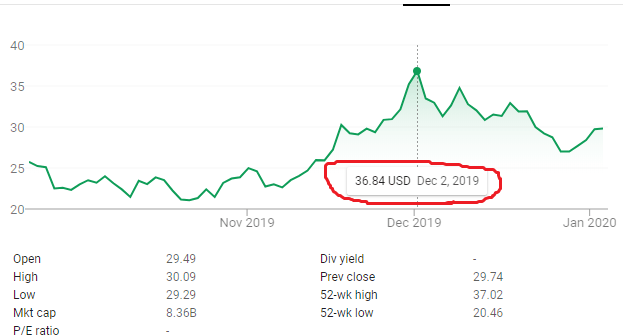

But what was the broader objective? Let’s take a look at Peloton’s stock price right before this controversy blew up around December 2nd:

And now December 5th:

As you can see, Peloton suffers a nearly six-dollar drop over the course of a few days, the perfect opportunity for someone SHORTING the stock. In the event they chose to wait a bit longer, Peloton actually hit $27.00 per share on December 26th.

So, is Wall Street paying for SJW campaigns in order to rig speculative bets on stocks?

I’d lean yes, but no one is really paying attention.

You must be logged in to post a comment.