Last weekend I finished the book Overdressed, which probably seems like an odd choice for one like me. To be fair, I do own a few bathrobes, yet little in my wardrobe comes near the likes of Imelda Marcos, or some Zoomer shopping haul queen. I basically buy what I need, and keep a few unique items around for the rare occasion when fanciful taste is needed. It would certainly be nice to have more, but I simply have not gotten around to caring enough.

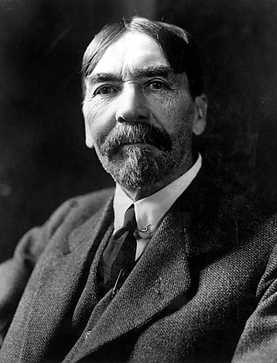

Obviously many people disagree, and in many cases with good reason. They’re not the question at stake. Instead, the book’s author dropped a term I had never heard of, even though it manifests in the real world remain as anything but uncommon: the Veblen good. The word’s namesake lies with Thorstein Veblen, an early 1900s economist who became associated with the progressive movement for his non-Marxist critiques of capitalism. Put simply, the term refers to a product which defies the laws of supply and demand by becoming more desired as it increases in value.

For many, the very idea is problematic. Of course supply and demand remains undisputed; just look at Chinese imports and general technology: they all went through the price floor as production and sales picked up over the years. But other goods do not. Rare wines, whether real or fake, are craved, even as they sell at millions on the bottle. Luxury cars can be priced well over the threshold of a townhouse’s mortgage loan, and still people chase the driver’s seat. One might even claim something similar for stocks, which can become overpriced mammoths and still attract the barking madness embodied by those pursuing extreme wealth.

Whether Veblen goods are a consequence of effective marketing by the rich to sell their lifestyle as being superior, nothing changes the underlying reality of how such products come to control our lives. Think of how many folks you know driving spruced up trucks or Hellcats simply to get them to and from work. There’s hardly any street racing or hard construction involved in use of those vehicles, just a fair-weather attempt to impress others. But whatever emptiness may clutch the actualized routine of luxury ownership, the prices continue being raised to great joy from buyers. I will have something everyone else doesn’t, goes the grey matter, along with countless more cerebral motherboards.

I suppose it’s like grinding an axe against the hordes of development at this point. Nevertheless, at times my heart wonders how much worse off we would actually be if folks did more with less, and treated what they had not as objects, but family. A few more monks, and a lot less celebrity.